A version of this article was previously published with the Northwest Public Power Association in August 2023.

The new Governmental Accounting Standards Board (GASB) Statement 96, Subscription-Based Information Technology Arrangements (SBITAs) has been published, with an implementation date of June 30, 2023, or December 31, 2023, effective for fiscal years beginning on or after June 15, 2022.

The new standard is intended to improve accounting and financial reporting of a SBITA and create greater consistency. Many municipal utilities face significant changes to accounting for SBITAs and reporting requirements with the upcoming implementation of GASB 96. However, the work your utilities put into the implementation of the lease accounting standard, GASB Statement 87, Leases, will support your implementation of GASB 96.

What Is a SBITA?

GASB 96 defines a SBITA as a contract that conveys control of the right to use another party’s IT software, alone or in combination with tangible capital assets, as specified in the contract, for a period of time in an exchange or exchange-like transaction.

GASB 96 doesn’t apply to the following:

- Contracts that provide the right to use the utility’s own IT software and associated tangible capital assets to other entities through a SBITA

- Contracts that convey control of the right to use another party’s combination of IT software and tangible capital assets that meets the definition of lease under GASB 87, in which the software component is insignificant when compared to the cost of the underlying tangible assets—for example, a computer with operating software or a smart copier connected to an IT system

- Contracts that meet the definition of a public-private and public-public partnership under GASB Statement 94, Public-Private and Public-Public Partnerships and Availability Payment Arrangements

- Licensing arrangements that provide a perpetual license to governments to use a vendor’s computer software meeting the requirements of GASB Statement 51, Accounting and Financial Reporting for Intangible Assets

Similarities to the Lease Standard

Many of the definitions and provisions in GASB 96 are effectively the same as those for a lessee under GASB 87.

These include provisions related to determining and recording:

- Length of contract

- Measurements for recording intangible assets and liabilities

- Bifurcation of contracts containing multiple components

GASB 96 scopes out short-term SBITAs, which have a maximum possible term under the SBITA contract of 12 months or less, including any options to extend regardless of the likelihood of being exercised.

What to Consider when Analyzing the IT Arrangement: Recognition and Measurement

To determine whether a contract conveys control of the right to use underlying IT assets, utilities should assess whether it has both the right to:

- Obtain the present service capacity from use of the underlying IT assets as specified in the contract

- Determine the nature and manner of use of the underlying IT assets as specified in the contract

If a contract qualifies as a SBITA, utilities should record the right-to-use subscription asset—an intangible asset—and a corresponding subscription liability at the present value of payments the utility expects to make during the subscription term. The commencement of the subscription term begins when the subscription asset is placed into service. This occurs when:

- The initial implementation stage is completed—described below

- The utility has obtained control of the right to use the underlying IT assets

Future subscription payments should be discounted using the interest rate the vendor charges the utility, which may be implicit in the contract. If the interest rate isn’t readily determinable, the utilities incremental borrowing rate should be used. Utilities should recognize amortization of the discount on the subscription liability as an outflow of resources, such as interest expense.

The challenge with IT arrangements is they often include multiple components in the same agreement. Hardware, software, implementation activities, training, and ongoing maintenance are just a few examples.

Each component may have its own term outlined in the agreement as well. Analyze each agreement and identify the components to be considered in calculation of right to use asset and liability versus components that should be expensed.

Implementation Costs

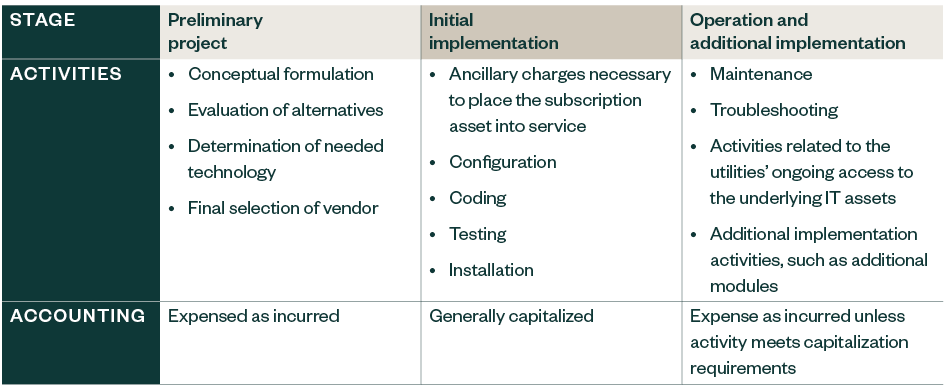

Activities associated with a SBITA should be grouped into one of three stages: preliminary project stage, initial implementation stage, or operation and additional implementation stage. In classifying outlays into the appropriate stage, the nature of the activity should be the determining factor.

Training costs should always be expensed as incurred, regardless of the stage in which they’re incurred.

Implementation Best Practices

The new standard requires the utility to identify and analyze all existing contracts to identify SBITAs, record contracts as a subscription asset and subscription liability, and determine necessary changes to financial statement presentations and disclosures for future years.

For many utilities, this process can be a substantial undertaking, requiring time and resources. Below are steps and recommended practices your utility can take to prepare for implementation and benefit from changes introduced in the new standard.

Entity-Wide Implementation Team

Many utilities assume financial reporting preparation and the new GASB standards are the accounting department’s responsibility. However, changes introduced by GASB 96 require a more comprehensive approach.

While accounting and finance should be involved in implementing and reviewing the standard, the team should also include key personnel from every department such as legal, IT, and operations.

This team structure ensures relevant documentation across departments is identified to help provide a system of check and balances, allowing organizations to catalogue all relevant agreements that could be subject to GASB 96 requirements.

Internal Controls

Throughout the evaluation process, the implementation team should continuously assess the utility’s existing internal controls and discuss areas for improvement, such as segregation of duties, documentation, and communication between departments.

Enhancing internal controls can help your utility implement and maintain GASB 96 changes more effectively and efficiently without adding a burden of redundant controls.

Areas of focus should include:

- Segregation of duties

- Completing and maintaining appropriate documentation

- Communication

Segregation of Duties

This helps prevent errors and reduce overall risk. Tasks that should be assigned to a team and monitored throughout implementation include:

- Preparing journal entries to be posted

- Approving journal entries to be recorded in the general ledger

- Recording and maintaining the amortization schedules

Completing and Maintaining Appropriate Documentation

Maintaining complete and accurate documentation provides consistency in processes, is a key training tool, and is critical for legal and regulatory compliance. A few areas that documentation should be completed and maintained include:

- Establishing audit trails from individual SBITA terms to calculate asset and liability balances to amounts recorded in the general ledger

- Documentation of preparation and review of calculations

- Evaluation of bond covenants or debt limit provisions that may need to be modified

Communication

Strong communication can help a utility efficiently accomplish tasks such as:

- Affirming completeness of the IT contracts population at the time of implementation and for future reporting

- Communicating new requirements under GASB 96 to stakeholders

- Training staff throughout the utility

- Providing timely identification of new or amended IT agreements

- Providing correct accounting and disclosures in the financial statements

We’re Here to Help

For more information on GASB 96 implementation, contact your Moss Adams professional.